The investigation continues into the origin of the Camp fire, which some say started with a faulty PG&E wire in Pulga, California. (Carolyn Cole / Los Angeles Times / TNS)

Sammy Roth of LA Times digs deeper than others into the fallout from PG&E’s wildfire-induced bankrupcy. The article published in The Seattle Times is PG&E bankruptcy could undermine utilities’ efforts against climate change. Excerpts below with my bolds.

Solar and wind developers depend on creditworthy utilities to buy electricity from their projects under long-term contracts, but that calculus changes in a world where a 30-year purchase agreement doesn’t guarantee 30 years of payments.

The Golden State has dramatically reduced planet-warming emissions from the electricity sector, largely by requiring utilities to increase their use of solar and wind power and fund energy-efficiency upgrades for homes and businesses. Lawmakers recently set a target of 100 percent climate-friendly electricity by 2045.

But those government mandates have depended on Pacific Gas & Electric and other utilities being able to invest tens of billions of dollars in clean-energy technologies.

The massive Topaz solar farm in California’s San Luis Obispo County, an electricity supplier to PG&E owned by Warren Buffett’s Berkshire Hathaway Energy, also saw its credit rating downgraded to junk status this month, amid fears the San Francisco-based utility won’t be able to pay its bills in full.

In the short term, PG&E might stop signing renewable-energy contracts, although contracting had already slowed in the last few years as customers departed in droves for newly established local energy providers run by city and county governments. In the long term, renewable-energy developers and their lenders may hesitate to do business with PG&E — and, potentially, with other California utilities that could also face significant future wildfire costs.

“If we’re having a couple billion dollars a year of fire damage and insurance losses, quite apart from PG&E, this is going to put the entire state of California at risk,” said V. John White, executive director of the Center for Energy Efficiency and Renewable Technologies, a Sacramento-based trade group.

Renewable-energy firms were alarmed by the news of PG&E’s impending bankruptcy filing, and it’s not hard to understand why. Solar and wind developers depend on stable, creditworthy utilities to buy electricity from their projects under long-term contracts known as power-purchase agreements. They’re able to get low-cost loans to build their projects because lenders see little to no risk of a utility defaulting on those contracts.

But that calculus changes in a world where a 30-year power-purchase agreement doesn’t guarantee 30 years of payments at the agreed-upon price, said Ben Serrurier, a San Francisco-based policy manager for solar developer Cypress Creek Renewables. There’s concern in the industry that a bankruptcy court judge could order PG&E to reduce its payments to solar- and wind-project owners to help the company pay off other debts.

WIND ENERGY: Wind turbines in the Tehachapi-Mojave Wind Resource Area near the city of Mojave, California. (Brian van der Brug / Los Angeles Times / TNS)

“Once you start questioning the sanctity of contracted revenue, you begin to introduce a new risk into renewable-energy project development. So much about project development is about reducing risk so you can reduce your capital cost,” Serrurier said.

It’s not just clean-energy investments that are at risk. In another cruel bit of irony, PG&E’s bankruptcy filing could also make it more difficult for California utilities to raise the capital needed to harden their infrastructure against wildfire, said Travis Kavulla, a former president of the National Association of Regulatory Utility Commissioners who now serves as director of energy policy at the R Street Institute, a center-right think tank.

“Bankruptcies are tough. It means people may lose their pensions or get them cut. It means people who invested in projects in California, based on what they thought was a pretty airtight business model of a regulated utility, are getting stiffed,” Kavulla said. “It could create longer-running harms where California is viewed as a market to avoid investment in.”

PG&E has lurched from crisis to crisis since 2010, when one of the company’s gas pipelines exploded in a residential neighborhood in San Bruno, killing eight people. The company was ultimately fined $1.6 billion by the state regulators and $3 million by a federal judge. Last month, the California Public Utilities Commission accused PG&E of continuing to commit pipeline-safety violations in the years after the gas pipeline explosion.

More recently, deadly wildfires have made PG&E the target of raucous protests. The utility’s infrastructure was found to have sparked or contributed to more than a dozen fires that collectively killed 22 people in 2017. State investigators have yet to determine if PG&E is also responsible for 2017’s Tubbs fire, which killed an additional 22 people, and the 2018 Camp fire, which killed 86 people and destroyed most of the town of Paradise.

Some critics have called for lawmakers to break up the massive company, which serves 16 million Californians, and replace it with smaller, government-run electric utilities. But it’s not clear how feasible that would be, or whether it would accomplish anything more than transferring PG&E’s huge liabilities to local governments.Renewable-energy developers, meanwhile, see stabilizing PG&E as an urgent priority. After a series of fires devastated Northern California in October 2017, clean-energy trade groups began urging state lawmakers to help PG&E and other utilities cope with the liability that can ensue if their infrastructure sparks a fire.

In a May 2018 letter to legislative leaders last year, representatives of the solar, wind, geothermal and biomass energy industries said California must find a way to sustain financially solvent investor-owned utilities. Failure to act, they said, “imperils our markets and progress toward our climate goals.”

Ralph Cavanagh, co-director of the energy program at the Natural Resources Defense Council, described PG&E as a “tremendous asset” for meeting the state’s climate-change targets.

He said the state’s three big investor-owned utilities — which also include Southern California Edison and San Diego Gas & Electric — are crucial to making the investments needed to meet California’s ambitious climate targets, including the 100 percent clean-energy mandate and a long-term goal of cutting greenhouse-gas emissions by 80 percent below 1990 levels by 2050.

Those investments are likely to include more solar and wind farms, large-scale batteries and other energy storage technologies, and electric vehicle chargers.

“Utilities have been essential clean-energy partners. We don’t want to have to do without them, and we shouldn’t have to do it without them,” Cavanagh said. “It would be much more difficult without them.”

Cavanagh thinks state legislators should change the law so that PG&E and other utilities aren’t held liable for fires sparked by their infrastructure unless they’re found to be negligent.

California’s new Gov. Gavin Newsom could play a key role in determining how the state responds to PG&E’s bankruptcy. At a news conference Monday, he said the state is “still committed to investing in our climate goals.”

“I do not believe, based on the information that I have, that those goals will be significantly altered in the short term as it relates to existing purchases of renewable energy. We are long-term focused on all of the existing requirements that PG&E has encumbered and embraced,” Newsom said.

The Legislature already gave the investor-owned utilities a measure of relief last year by approving Senate Bill 901, which allows them to charge ratepayers for some of the costs they may incur from the 2017 fires. But it’s unclear whether lawmakers have the appetite for another bill that will inevitably be derided as a utility bailout.

A lot could depend on how the bankruptcy court judge handles the company’s existing solar and wind contracts, with developers watching to see whether the owners of those projects keep getting paid in full.

It’s also possible the effects of PG&E’s bankruptcy may not be as serious as solar and wind developers fear.

Ravi Manghani, director of energy storage at the research and consulting firm Wood Mackenzie Power and Renewables, said existing clean-energy contracts “will likely get renegotiated,” with project owners being forced to accept lower payments. But in the long run, he said, California officials “are still committed to the renewable future, and it’s not like the region’s resource and reliability needs disappear with the bankruptcy.”

Another key factor: The investor-owned utilities aren’t the only ones buying clean energy in California.

Most new contracts in recent years have actually been signed by local energy providers known as community choice aggregators, which can be formed by city and county governments whose residents are served by an investor-owned utility. The government-run power agencies decide what kind of electricity to buy for their communities and how much to charge, while investor-owned utilities continue to operate the poles and wires.

There are 19 aggregators operating in California, including Clean Power Alliance, which will begin serving nearly 1 million homes in Los Angeles and Ventura counties in February. The aggregators have signed long-term contracts for more than 2,000 megawatts of renewable energy, according to the California Community Choice Assn.

But the community choice aggregators don’t have the financial wherewithal of the investor-owned utilities, and many of them don’t have credit ratings yet, said Matt Vespa, an attorney at the environmental group Earthjustice. He likes the aggregators but doesn’t think they alone can eliminate planet-warming carbon-dioxide emissions from California’s electric grid.

“When you’re talking about the scale of what we need to do to aggressively decarbonize … they’re not in a position to finance that,” Vespa said.

Summary

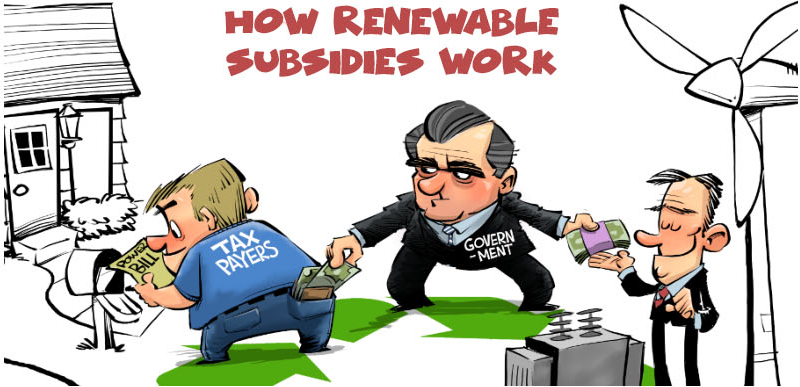

California continues to serve as a learning laboratory for misguided and futile climate policies. This time the lesson (for those with eyes to see) is to demonstrate that renewable energy programs are parasites who feast on the financial lifeblood of their host utilities until the cash is gone.

See Also: California: World Leading Climate Hypocrite

Reblogged this on Climate Collections.

LikeLike

Madness takes its toll – it’s just a step to the left … your Epstein video sums up the renewable fiasco so nicely..

LikeLiked by 1 person

Pulga means flea. The biggest problem California has to cope with is parasites. Biological parasites need not have brains–and this goes for the human variety as well.

LikeLike

Ron,

I noticed that PG&E hasn’t updated their Vanity page recently:

https://www.pgecommitment.com/?WT_mc_id=Vanity_commitment

It will be interesting to see what happens to the” climate credit” that was scheduled to be distributed to residential electrical PG&E customers this spring. I assume the $39/per billing meter credit previously set aside, from an accounting standpoint that came from cap and trade generation fees, will be halted by the bankruptcy judge.

The cap and trade program was extended to natural gas a couple years ago. I think that program was scheduled to provide a $29 climate credit for each PG&E residential natural gas customer this spring as well.

Hopefully the “Vanity commitment” web page will be updated in the near future……………

The bankruptcy judge is going to have to figure our if the various “community choice aggregators” in PG&E territory are required to give up the cap and trade fund allocations they receive from PG&E as well.

LikeLike

Found it in the spam filter don’t know why there.

LikeLike

I wonder who’s pocket(s) PG&E’s “climate credits” are going to flow into later this spring. The 39 bucks per billing meter scheduled for distribution to PG&E residential customers this spring could always be set aside to pay a few legal fees.

My longer post on the subject seems to have gotten stuck in moderation.

LikeLike

Matt Vespa of Eartjustice gets one thing right, he used the full description “carbon-dioxide” in his statement. Just how much change in the “average” planet temperature (up or down) shutting off all of California’s electric grid today would make is probably impossible to measure.

LikeLike

Reblogged this on Climate- Science.

LikeLike