Car sales in China, the world’s largest car market, plummeted by 19 per cent in December.AFP Getty file photo

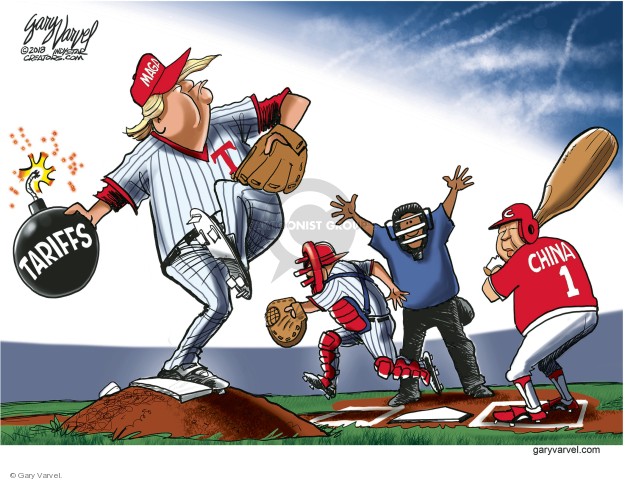

Keep it under your hat, but Trump is getting the best of China in the trade confrontation. Lawrence Solomon explains in a Financial Times article Remember Trump’s supposedly ‘lose-lose’ trade war? He’s winning. China’s losing. Excerpts in italics with my bolds.

The tariffs clearly hurt China’s economy more than America’s

Not that long ago, China’s economy was seen as a juggernaut that would soon overtake America’s to become the world’s largest. “Made in China 2025,” the Chinese government’s blueprint to take over manufacturing, was seen as an existential threat to U.S. technological leadership. Speculation had the Chinese yuan replacing the United States dollar as the world’s reserve currency.

What a difference a trade war makes. No one marvels at the Chinese economy today.

What a difference a trade war makes. No one marvels at the Chinese economy today.

Car sales in China, the world’s largest car market, plummeted by 19 per cent in December, capping a six-per-cent decline in sales for the 2018 year, the industry’s first fall in 20 years. Goldman Sachs predicts the decline will steepen to seven per cent in 2019. More broadly, China’s private and public manufacturing sectors both contracted in December. China’s mainland stock markets, which declined 25 per cent in 2018, aren’t doing well either. Neither is growth in consumer spending, which is at a 15-year low. The government is backpedalling on its targets for “Made in China 2025,” and its other high-profile initiatives — the much-ballyhooed Asian Infrastructure Investment Bank and the Belt and Road Initiative — are falling short.

In fact, the entire Chinese economy may not only be falling short, it may never have performed as well as claimed. Many believe that China’s official economic growth rate, a fabulous 6.5 per cent, is more a fable. A World Bank estimate for 2016 put China’s economic growth at 1.1 per cent, with other estimates showing low or even negative growth. Also worrying is the potentially catastrophic hidden debt that fuelled China’s growth — as much as US$6 trillion by China’s local governments alone, according to S&P Global Ratings, which called it “a debt iceberg with titanic credit risks.”

In fact, the entire Chinese economy may not only be falling short, it may never have performed as well as claimed. Many believe that China’s official economic growth rate, a fabulous 6.5 per cent, is more a fable. A World Bank estimate for 2016 put China’s economic growth at 1.1 per cent, with other estimates showing low or even negative growth. Also worrying is the potentially catastrophic hidden debt that fuelled China’s growth — as much as US$6 trillion by China’s local governments alone, according to S&P Global Ratings, which called it “a debt iceberg with titanic credit risks.”

Many authorities point to the trade war to explain in part these poor metrics, typically adding that trade wars are always lose-lose. Yet while China clearly seems a loser, the same can’t be said for the U.S., whose economy is on fire.

In contrast to the 15- and 20-year lows logged by China’s economic indicators, the U.S. is racking up 20-, 30-, 40- and 50-year highs.

Wages are up, especially for those traditionally worse off, while unemployment rates for blacks, Hispanics and women are at lows not seen in decades. The U.S. economy has added 4.8 million jobs since Donald Trump was elected president, with U.S. manufacturers last year adding 284,000 jobs, the most in more than 20 years. Americans are ditching food stamps and disability payments for well-paying jobs. “Put it together, and this is the best time for the American labor market in at least 18 years and maybe closer to 50,” The New York Times noted in November.

So much for the claims of the U.S. Chamber of Commerce, which warned that Trump’s tariff policy on imported products “endangers the jobs of millions of workers”; of the Tax Foundation, which predicted that Trump’s tariffs would decrease Americans’ wages; of Bank of England Governor Mark Carney, who stated the trade war with China would reduce U.S. GDP; and of the Heritage Foundation, which called Trump’s tariffs “ineffective and dangerous”.

While China’s demise and America’s rise can’t all or even mostly be attributed to Trump’s tariffs, the tariffs clearly hurt China’s economy more than America’s. For one thing, the “tax” that tariffs represent has mostly been paid by China. According to a recent policy brief from EconPol Europe, a network of researchers in the European Union, U.S. companies and consumers will pay only 4.5 per cent of the 25-per-cent tariffs on US$250 billion of Chinese goods, with the other 20.5 per cent falling on Chinese producers. The EconPol report found that the Trump administration selected easily replaced products, forcing China’s exporters to cut selling prices to keep buyers. “Through its strategic choice of Chinese products, the U.S. government was not only able to minimize the negative effects on U.S. consumers and firms, but also to create substantial net welfare gains in the U.S.,” the authors determined, adding that the tariffs will accomplish Trump’s goals of lowering the trade deficit with China.

More importantly, the tariffs have spurred investment confidence in the U.S., not only in steel and aluminum, where dozens of plants are either being built or reopened, but in the broader economy, too. A UBS Wealth Management Americas survey found that 71 per cent of American business owners support additional tariffs on imports from China, with only one-third believing tariffs would hurt them. A Bloomberg Businessweek article in October bore out the view that tariffs hitting steel and aluminum imports would be beneficial: “Employment in metal-using industries has risen since the tariffs went into effect last spring, (more than) the increase for overall manufacturing.”

The American public likes tariffs, too: According to a Mellman Group and Public Opinion Strategies poll in October, nearly 60 per cent of likely voters deem it important for Trump and Congress to “place trade restrictions on countries that violate trade agreements.” When the tariffs apply to China, the public doubtless also likes them for non-economic factors — to rein in one of the world’s worst human rights offenders and America’s chief military threat.

Contrary to the conventional wisdom, this trade war is anything but lose-lose. This one is a big win for the U.S.

• Lawrence Solomon is a policy analyst with Toronto-based Probe International.

https://theconservativetreehouse.com/2018/12/31/chang-2018-is-the-year-beijing-realized-president-trump-was-outwitting-them/

Structural flaws to do with oppressive nature of Chinese regime. Compliant culture – majority of Chinese citizens do not create or innovate. Poor infrastructure planning for manufacturing, Need to import raw materials at risk of geopolitical leverage.

LikeLike

beth, thanks for linking to that article. It shows a side of Trump not anywhere reported: an economic General preparing carefully the ground and setting up his opponent before starting open conflict. As usual he gets no credit and works behind the scenes while the media is distracting by trivia.

LikeLiked by 1 person

You do realise that Australia goes into recession if China collapses!

LikeLike

Ron,

Trump seems to be one of the few world leaders standing up for the interest of the free enterprise Nation State. We in Oz send China our coal and pay enormous energy costs re inefficient renewable energy. Ref latest post @JoNova.

Enjoy yr informative posts Ron, and comments at Cliscep as well.

LikeLike

Thanks beth. It seems obvious to a businessman that when you have leverage in a commercial relationship, you use it to advance your interests. Evidence of that dynamic is everywhere, for example the auto industry. Car assemblers like GM, Ford, etc. extract the best possible prices from the parts suppliers, while being careful not to drive them under. Trump has known for decades that China needs the US more than the reverse, so he’s pressing that advantage. It’s foolish to give it away for nothing, as WH predecessors have done.

LikeLiked by 1 person

Joel Kotkin has a post up on China (1) that is worth a gander. Joel’s insights into the demographics and political/anthropological changes occurring in China back in 1994 were spot.

I can’t recall if he went on our 2 week meet and greet events in the Far East back in the day. I must of whipped out quite a few brain cells/memories the last night of our trip. Warm sake is tasty….

1) http://www.newgeography.com/content/006193-the-middle-kingdom-and-us-economy

LikeLike

Thanks kakotoa for commenting and for that linked article. Kotkin does add some insights as to why China might be vulnerable in this conflict, despite that leader’s grip on his country.

“China’s profound economic problems weaken Xi against Trump. The country’s rising debt, much of it tied to real estate speculation, threatens the country’s fundamental health. If China tries to become more responsible on environmental issues — it is now a bigger emitter than the U.S. and the European Union combined — it could further weaken the country’s industrial competitiveness.

In contrast, despite all the hysteria from the establishment in both parties, Trump’s trade policies have not yet undermined the economy. Indeed U.S. employment, now at historically high levels, has been resurging, including in the industrial sector. Wages are increasing for manufacturing and other blue-collar workers, something that President Obama’s “progressive regime” never accomplished.”

LikeLike